What's all the fuss about Capital Gains Tax?

.](/uploads/images/CGT-Temp-Resident-definition.webp)

Update

01 June 2017

The Bill to implement part of the Budget measures (CGT) was introduced yesterday. The measures will only prevent foreign tax residents from claiming the CGT main residence exemption, and not temporary residents.

New Zealanders residing in Australia are generally not foreign residents, and therefore not captured by the proposed changes to CGT. Please seek financial advice to confirm your tax liability when selling property.

What's all the fuss about Kiwis and Capital Gains Tax?

23 May 2017

Oz Kiwi opinion

If you're wondering what all the fuss is about Kiwis and Capital Gains Tax, here are the basics.

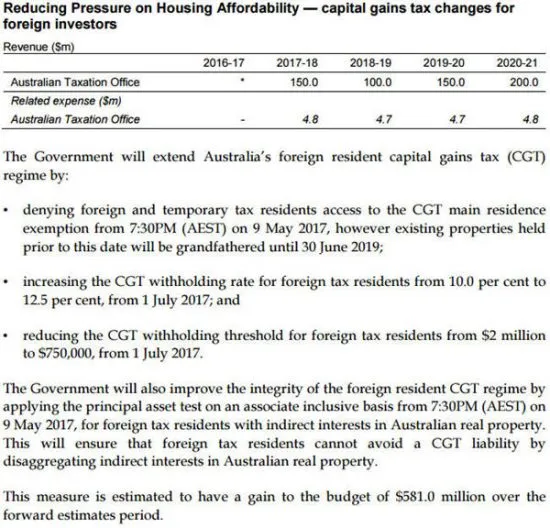

The Budget proposes to strip the CGT main residence exemption from foreign and temporary tax residents. Those affected would need to pay CGT at a rate of up to 45% (+ Medicare levy) whenever they sold their family home.

The Income Tax Assessment Act 1997, the legislation that governs CGT, defines 'temporary resident' in such a way as to include most SCV holders who settled in Australia after 26 February 2001.

In other words, the most straightforward reading of the Budget is that many Kiwis in Australia will be forced to pay Capital Gains Tax whenever they sell their home.

Indeed, there is no suggestion in the Budget that 'temporary tax resident' has anything other than its current meaning and there is no mention of any exemption for New Zealanders.

At the same time, the changes make little sense given the Government's stated intention is to target foreign property investors, not long-term residents. We've also heard suggestions that the Government never intended Kiwis to be caught by these changes.

However, so far, no one has been able to get a definitive statement from the Government about whether the changes will ultimately affect New Zealanders.

We have requested an urgent clarification on the matter and will let you know as soon as we receive a response.

Extract from Budget 2017-18, page 27 of Budget Measures Budget Paper No. 2 2017-18

Update

The Treasury Laws Amendment (Reducing Pressure on Housing Affordability Measures No. 2) Bill 2018 was introduced into Parliament in February 2018.